Drivers Allege Insurance Companies Are Short-Changing Them After Accidents

Nashville Drivers Say Insurance Companies Are Short-Changing Them After Accidents

NASHVILLE, TN — A growing number of Middle Tennessee drivers are raising concerns over how insurance companies are calculating the value of their vehicles after collisions — and many are now turning to independent appraisers for help.

At Auto Appraisal Network of Nashville, calls are pouring in from residents who believe they’ve received unfair settlement offers following accidents that weren’t their fault. According to the company’s certified appraisers, those concerns are often well-founded.

“We’re seeing a disturbing pattern,” said a representative from Auto Appraisal Network of Nashville. “In many cases, the comparison vehicles being used to determine a car’s post-accident value don’t actually exist.”

The culprit? Artificial intelligence. Insurance companies are increasingly relying on AI-driven tools to source comparable vehicle sales — or “comps” — to assess diminished value. But according to appraisers, these tools are generating fictional data that’s never being double-checked by a human reviewer.

“This information is simply pulled into a system and run through a formula. The result is often a lowball offer that doesn’t reflect the true value of the car,” the representative said.

Understanding Diminished Value

Diminished value refers to the decrease in a vehicle’s market value after it has been in an accident, even if it has been fully repaired. Buyers typically pay less for vehicles with a collision history, and under Tennessee law, drivers who were not at fault may be entitled to compensation for that loss.

However, most vehicle owners aren’t aware of this type of claim until long after the accident — often when they try to sell or trade in the vehicle and are offered significantly less than expected.

Tennessee’s Diminished Value Rules

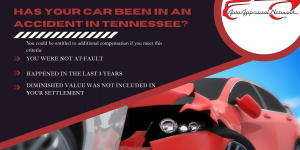

To qualify for a diminished value claim in Tennessee, several criteria must be met:

- The driver must not be at fault

- The claim must be filed with the at-fault party’s insurance

- The vehicle must be fully repaired

- The accident must have occurred within the past three years

- No previous diminished value claim can have been filed

- An appraisal must be conducted by a certified, independent appraiser

Drivers Encouraged to Get Second Opinions

If a settlement feels low — or if there’s suspicion that AI-generated data was used in the valuation — experts recommend seeking a second opinion.

“Not all appraisers are the same,” said the Nashville-based appraiser. “Look for someone with experience, proper certification, and a reputation for transparency. A quality appraisal can make the difference between a fair payout and leaving money on the table.”

Advocating for Fair Value

Auto Appraisal Network of Nashville says it provides detailed, fully documented reports based on real market data — not artificial intelligence shortcuts. The company encourages anyone who suspects they were undervalued to seek an independent appraisal before accepting a payout.

“Insurance companies have a duty to make you whole,” the representative said. “We’re here to ensure that happens." The independent auto appraisal company is offering a free settlement review through Summer 2025.

For more information or to schedule an appraisal, visit Auto Appraisal Network of Nashville online or contact their office directly at (629) 272-3131.

Auto Appraisal Network of Nashville specializes in appraisals for classic, custom and collector vehicles, including cars, trucks, SUV's, motorcycles, boats and personal watercraft. We do appraisals for insurance policies and claims, such as diminished value and total loss, probate, bankruptcy, divorce, financing, fair market value and pre-purchase inspections.

Our appraisals are certified and accepted by the legal system, insurance companies and financial institutions. When you need an accurate, fair assessment of the value of your ride, you need Auto Appraisal Network of Nashville. Call (629) 272-3131 to schedule your appraisal today.

Tags

All insurance claim insurance settlement Insurance Adjuster Custom car appraisals diminished value appraisal in Nashville Auto Appraisal Network - Nashville Nashville Independent Car Appraiser total loss appraisal diminished value independent car appraiser in Nashville classic car appraiser BestcarappraisernashvilleRecent posts

Best Car Appraisal Companies in Nashville: 4 Local Experts Compared

Best Car Appraisal Companies in Nashville: 4 Local Experts Compared

If you’re searching for the best car appraisal company in Nashville, we've compared the top contenders. Who took the #1 spot? Find out here!

Drivers Allege Insurance Companies Are Short-Changing Them After Accidents

Drivers Allege Insurance Companies Are Short-Changing Them After Accidents

Drivers raise concerns over insurance low balling settlements following a collision— Here's how they are fighting it and winning.

Has Your Car Been in an Accident in Tennessee? You Might Be Entitled to More Than Just Repairs

Has Your Car Been in an Accident in Tennessee? You Might Be Entitled to More Than Just Repairs

Your vehicle is worth less after an accident, even after being repaired. The insurance company doesn't always account for this in the settlement.